A platform is as good as the business it generates

First requirement: easy implementation. Next: a sweet customer experience. Third: High rate of automated offers. Result: More business on the books, and new insight from analytics.

Lower cost. Faster implementation.

Underwriting Decision Engine

Generate automated underwriting decisions using pre-configured rules

Underwriting rules

Rules designed specifically for instant online decisions

Policy production and issue

Automatically compile and delivered policies

Underwriter Workbench

Allowing underwriters to process cases referred for manual review

Ready-to-go products

Reinsurer-supported product-pricing models, ready for your assumptions and margins

Responsive and configurable

Your mobile-responsive interface supports extensive configuration to your brand and products

Standard/published APIs

Interface to any administration system

Third-party data

Supports third-party data in the decision process.

Built-in support tools

PDF generator; embedded e-signature

Configure to your brand

RiskDX configuration settings provide significant differentiation through a wide range of options.

Agent support – agent can configure their landing page, still your brand, but also includes their information.

Underwriting rules can be easily modified and adapted to your customer market. Changes to the decision engine rules automatically update the website – one set of rules to maintain. Rules are versioned with change-over control.

Rapid low cost deployment – full implementation in a matter of weeks for under $100,000.

Understand Your Business Better

Analytics

With your new, branded version of RiskDX, you’ll:

- Digitally capture all input answers

- Plus you’ll see the routing path of deep reflexive questions, track journey exit points, and capture changes to answers

It’s the perfect place for predictive analytics to shine. As you gain greater sophistication with online sales, you’ll increase your ability to finetune your products, and offer more precise, data-driven feedback to your agents and marketing team.

Data Extracts

Think of data extracts as a free benefit of the RiskDX platform. You can download a data extract for offline analysis, feed extracts to your corporate data warehouse, or use one or more in the development and design of new online products.

Underwriting designed for automated issue

The RiskDX underwriting rules were developed for online issue, to maximize the number of automated decisions. Of those that complete the application, up to 85% receive an offer instantly. As well:

- Sophisticated analytics are used to generate a truthfulness score – can be used for verification or post-issue audit

- Probability of standard issue → prioritize in manual underwriting

- MIB incorporated at the rule level

Product

Traditional life insurance products – complex, multi-featured, and requiring explanation from an agent – can’t cut it online.

RiskDX term life insurance and critical illness products were designed specifically for online distribution. They require no explanation or advice, because they’re simple to understand, and have no hidden fees or unexpected features.

They can also be integrated to work alongside an existing portfolio of products.

Integration

RiskDX is designed to integrate with your current distribution channels, new or current products, and your existing processes and systems (ask us to show you how).

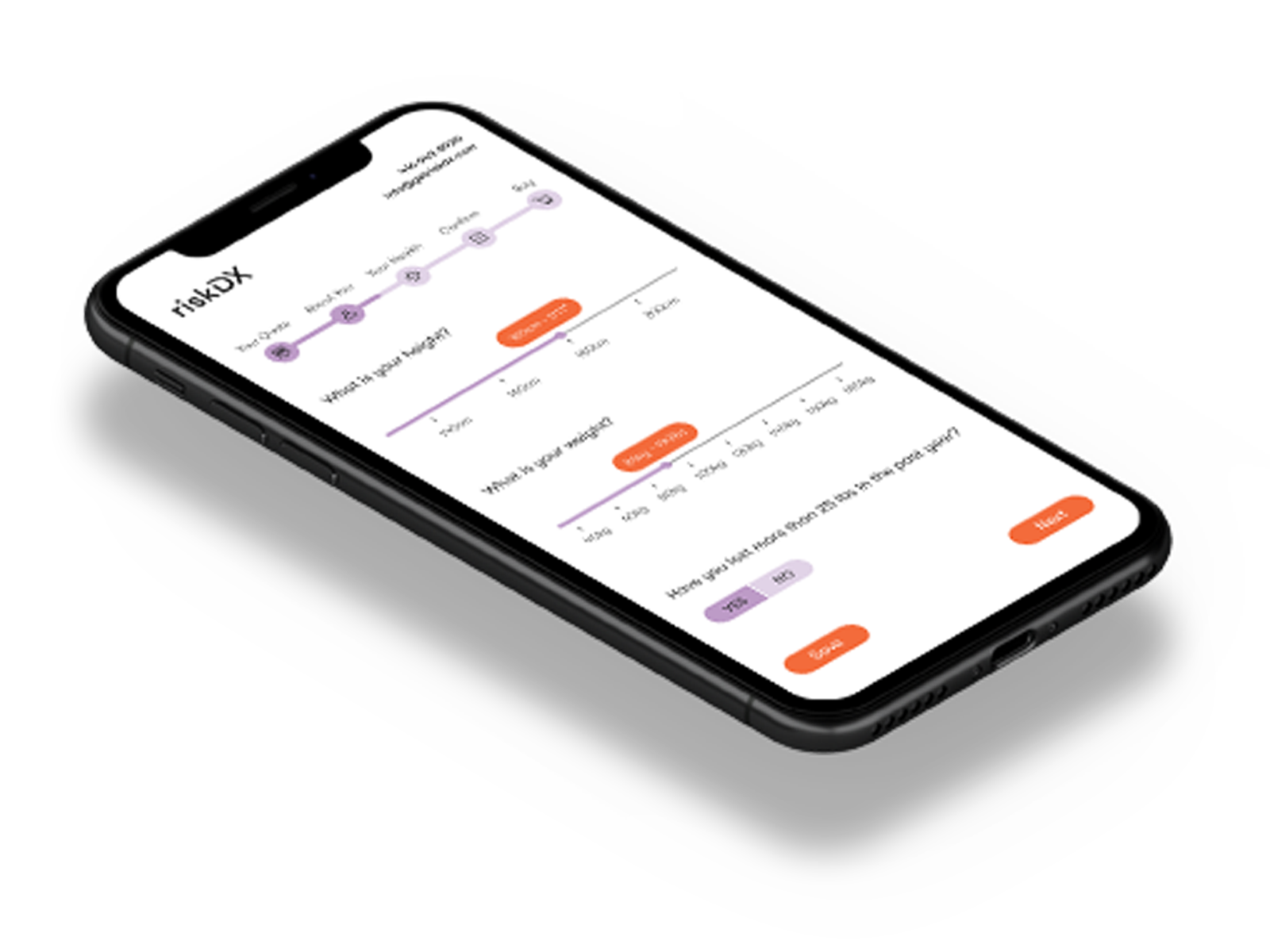

Easier for Your Customers to Buy

Today’s customer demands a path to purchase shaped by their expectations. Minimizing drop-off at every step is critical to business success.

How does the RiskDX path to purchase maximize new business on the books, up-sell, and cross-sell?

By wrapping the purchase experience around today’s expectations – including blazing speed and mobile capability – and using proven methodology to optimize retention. Meanwhile, behind the scenes, it quietly manages risk.

12 minutes, start-to-finish

Complete issued policy, minutes after starting

Immediate underwriting decisions

Caters for all scenarios: standard, rated, referred, exclusions, declined, deferred.

Complete path to purchase

Policy documents compiled and delivered

Multi-channel: agent, consumer- direct, and/or call-center

Customers buy on their terms, when and as they

Needs Analysis and Quote

Supporting applicants who are ready to buy, AND applicants that need more help

Agent access

Agents can see the progress of their applications and provide support through the Agent Console

Multi-product (primary products; cross-sell product; product-of-last-resort)

Increase sales through cross-sell and product-of-last-resort

Visually-impaired ready

Supports auto-readers for visually-impaired

Designed for the modern consumer

Integrated help & purchase nudges support the self-serve generation

Move to online distribution with the platform designed to delight your consumer, you, and ever one of your stakeholders.

Contact us to see a demo and learn more.